Young Captain Nemo (YCN) - Frequently Asked Questions (FAQs)*

* Please see the Disclaimer Page at the end of this Document

YCN 1 LLC FAQ

Last updated April 19, 20221. What are Content Ventures (“CV”)?

- Content focussed Intellectual Property (“IP”) with an engaging storyline and multiple characters, targeting a well-crafted universe and a global community

- Potential to become a valuable content franchise followed and celebrated by millions of fans

- Typically backed by Premium Creators with a significant fan following

- Opportunity for investors to own a piece of the IP organised within a dedicated Special Purpose Vehicle (SPV) and with benefits from interest payments, dividends, and capital gains

- YCN is RGI’s first CV

2. What are different types of CVs?

- Feature Films

- TV / Digital Shows (Long/Short Form)

- AR/VR/IR/MR

- Animation

- Music

- Metaverse

- Short Form Content

- Video Games and Play-to-Earn Games

- Digital Art

- Books and Publications

3. How did you acquire and develop the YCN Intellectual Property (“IP”)?

- RGI acquired a trilogy of books by a best-selling author, Jason Henderson

- The thesis to launch RGI’s first Content Venture (CV) as YCN was driven by the existing rich legacy of Jules Vernes’ 20,000 Leagues Under the Sea. Adding further value was the ability to launch a number of Web3 products around the world of YCN (for e.g. the world’s first Underwater Ocean Metaverse)

- RGI also values the natural storyline within YCN addressing the cause of ocean conservation

4. Who holds the rights for YCN’s IP?

- RGI (Delaware) and Animasia Studio Sdn Bhd (Malaysia)

5. What are the different products being developed for the YCN IP?

- Trilogy of feature films based on the books by best-selling author, Jason Henderson

- Spin-off TV Series (3 Seasons)

- A portfolio of NFTs with different utilities (for e.g. digital tickets for content access, digital art, music NFTs and other collectibles)

- Video games (including Play-to-Earn games)

- A first-of-its-kind underwater Metaverse

- Physical Merchandise (for e.g. Bags, Action Figures, Cards, etc)

6. What are the targeted budgets and costs for each of YCN’s content products?

- On average, each animated feature film will cost ~$4-5mn and each season of the TV Series will cost ~$5-6mn

- Additional points:

- 1. The overall cost of production could potentially be lower as a result of cash rebates / incentives received from the local governments where the content is produced

- 2. Given the reinvestment of requisite profits, YCN’s current fundraise is $8mn

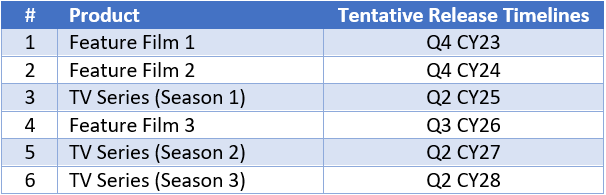

7. What are the targeted release dates?

- Additionally, YCN will also be launching multiple Web3 products, including NFTs, Play-to Earn Games and a first-of-its-kind underwater Metaverse

- These products launches are expected to commence from the first quarter of 2023 and are expected to generate regular and continuous revenue

8. What are YCN’s targeted revenues? Key assumptions behind the revenues?

- The total targeted revenues over a period of 7-8 years are projected to be in excess of ~$100mn

- The key assumptions for the projected revenues are driven from relative data as well as RGI’s internal research team’s projections

9. How much will YCN’s first animated feature film cost?

- $4 -$5mn

10. What are the different sources of YCN’s revenues? Why does RGI think it’s realistic?

- Key sources of revenues (projected in excess of ~$100mn over a 7-8 year period + projected library value of over ~$100mn+):

- 1. Revenue From Content

- 2. Revenue From Merchandising.

- 3. Revenue from Web3 Products, including NFTs, Metaverse and Play-to-Earn games

- YCN believes the assumptions are realistic since they are based upon the following:

- 1. YCN IP’s legacy

- 2. Creative and business team’s pedigree and track record

- 3. First-of-its-kind monetization plan of Web3 enabled products

11. What additional derivative revenue do you see coming?

- Association with theme parks

- FMCG products

- Short form content

- Podcasts

- Comics (digital and physical)

12. Why is RGI so excited about NFTs when the market is depressed?

- Most of the current NFTs are standalone products therefore have limited possibilities of long-term value creation

- YCN’s NFTs are backed by a credible content franchise which has a rich legacy and are not just backed by well-defined utilities (digital tickets, music, collectibles) but also a wide range of revenue from both traditional and Web3 distribution

- Backed by premium creators, YCN will also benefit from the targeted global fan community, which provides a good consumer base for YCN’s NFTs

13. Why is YCN called a Web3 IP? Is Web3 even important when YCN is a mere animated feature film?

- YCN is a Web3 IP because:

- 1. All YCN content products will be distributed to the global fan community through a blockchain-enabled platform – RainBlox

- 2. RainBlox will also manage all the smart contracts pertaining to investors, creators and communities

- 3. YCN will be launching a portfolio of Web3 products, including NFTs, Play-to-Earn games and a Metaverse

- Importance of Web3 IP:

- 1. Substantially enhances transparency, including automated pay-outs for all stakeholders

- 2. Enables direct creator-fan community building, which allows for Direct to Fan (DiFA) monetization

- 3. Potentially provides for liquidity through fractionalisation and through trading (tokens, NFTs)

14. Who are in YCN’s production team and what makes them so distinctive?

- YCN’s creative team have been nominated for multiple awards (including Emmy nominations) and have demonstrated abilities to create successful animated franchises. Below is a snapshot of their credentials:

- The core business team has a proven track record of building diverse businesses from start-up-to-IPO and have also invested early in a number of unicorns. Below is a snapshot of their credentials:

15. What are RGI and Animasia's credentials?

- Rainshine Global Inc:

- 1. RGI has created, distributed, and monetized a large portfolio of content products. The company is comprised of individuals who are proven entrepreneurs with experience in building successful companies and have a track record for generating high returns

- 2. RGI’s ~100-member team has also created award-winning original content and has active relationships with leading global companies such as Amazon (including Audible), Disney, Netflix, Spotify, Sony, and YouTube (on the distribution end of the business). It also has partnerships with highly reputable content companies such as Imagine Entertainment, Faraway Road Productions and Macro, etc

- 3. RGI’s talent attachment includes some of the most influential and popular artists who are Oscars, Emmy and BAFTA winners / nominees

- 4. RGI is also the promoter of RainBlox©, a Blockchain-enabled Media 3.0 platform

- Animasia Studio Sdn Bhd:

- 1. Established since 2005 as a boutique animation studio that focus on original IP creation, Animasia have grown to operate 4 production pipelines (both 2D and CG) in Malaysia that serve to enhance the production value chain from Pre to Post production

- 2. The studio has produced over 400 hours of contents in the past years, with many successful IPs being licensed and broadcast over Disney, Cartoon Network, Netflix, CCTV etc. Key IPs include ABC Monsters, Chuck Chicken, Harry & Bunnie, Supa Strikas and a whole new slate of projects coming in 2023/2024

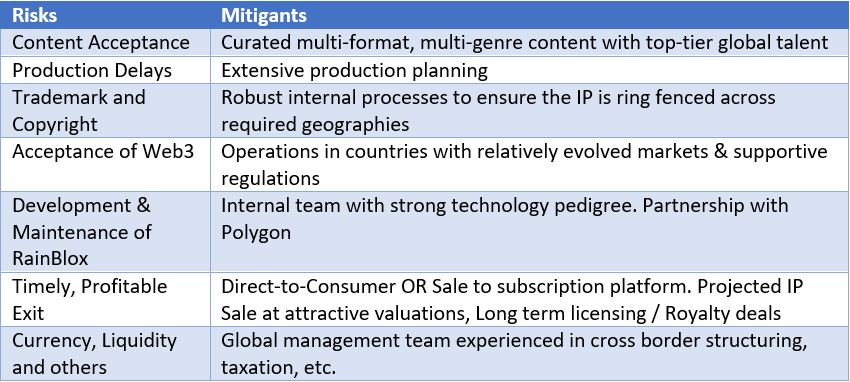

16. What are the risks for YCN? How is RGI mitigating them?

17. What if the first YCN animated feature film flops?

- YCN’s first animated feature film is tentatively scheduled for a December 2023 release. Prior to this, YCN’s fan building and monetization initiatives, which include global launches for music NFTs, Art & collectible NFTs and Play-to-Earn games, etc

- Additionally, branded CVs (like YCN) have the potential of returning a large portion of the invested capital from sale of selective territory rights (which could be monetized before the first film’s release)

18. How does an investor make money or de-risk? Does the investor have liquidity?

- Investors receive an 8% annual coupon commencing from the date of their investment, until principal payback

- The current projections anticipate a 3 year pay-back period

- After investors receive back their invested capital, the profit-sharing ratio between investors and producers is 30%/70% (adjusted for investor coupon pay-outs)

- Web3 products (NFT, Metaverse and Play-to-Earn games) will create additional avenues of monetization and potential liquidity for investors

19. Has YCN insured the project?

- Upon completion of fundraise, YCN will insure the project through E&O and through completion bonds

20. What is YCN’s distribution strategy?

- Premium Video on Demand (“PVOD”):

- YCN’s fan community will have exclusive and privileged access to the first feature film, which will be for a duration of 30-60 days (to be decided closer to the release of the first feature film). The feature film will be distributed through a blockchain-enabled platform – RainBlox

- Subscription Video on Demand (“SVOD”):

- Following this, YCN will engage with one or several streaming platforms, potentially including Apple Appstore, Google Play, Amazon, etc

21. Do you have industry relationships and partnerships to promote and distribute YCN?

- Animoca Brands (Web3 collaborator)

- Polygon (Blockchain support)

- Creator+ (Global community building)

- Additionally, RGI’s global advisors include: Micheal Montgomery (Founding Partner of Dreamworks; Ex-CFO Euro Disney), Ben Grubbs (Founder, Next10 Ventures & Creator+), Nicole David (Entertainment Advisor, Ex SVP – William Morris Endeavor) and David Johnson (Ex-CEO – EMI Music)

22. How do you envisage effective Community Building in YCN?

- An integral part of YCN’s strategy is to have fans become investors and active community participants who also promote the CV Franchise. Towards achieving such an objective, YCN will raise capital from angel networks and through crowd-funding initiatives, which will be recorded on ‘smart contracts’, housed on RainBlox

- As a part of its efforts, YCN will activate premium celebrity-led campaigns across multiple social media platforms. YCN also aims to sign up popular voice artists (cast) with robust social media following, which further enhances the reach of YCN’s CV franchise globally and also supports in community building efforts

- YCN also intends to build multiple Web3 products, which will not only give the fans, investors an avenue to monetize their investment, but also provide YCN with novel methods to reach out to a wider audience and build an engaged, enthusiastic and enduring community of fans

23. What is the stake of the key creative and business management teams in YCN?

- a. The team will have a stake of up to 10%, before dilution to investors

Disclaimers

This FAQs have been prepared solely for information purposes only. They do not constitute or form part of any offer or invitation to sell or issue, or any solicitation of any offer to purchase or subscribe for, any securities in any jurisdiction, nor shall it or any part of it, or the fact of its delivery or availability, form the basis of, or be relied upon in connection with, or act as an inducement to enter into, any contract or commitment whatsoever with respect to any securities. No part of the FAQ constitutes investment, legal, tax, regulatory, accounting or other advice of any kind

Certain information contained in the FAQs are from third party sources, which has not been independently verified. No responsibility is accepted, and no representation or warranty is made, by YCN 1 LLC as to the accuracy, reliability or completeness of such information or as to the reasonableness of any assumptions on which any of the same is based or the use of any of the same. The statements contained in the FAQs are made as at the date of these FAQs, unless another time is specified in relation to them, and the delivery or availability of these FAQs at any given time shall not give rise to any implication that there has been no change in the facts set forth in this document since that date. YCN 1 LLC. is under no obligation to update or keep current the information contained herein or to correct any inaccuracy contained herein except as explicitly required by law

The FAQs contain certain forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. The forward-looking statements are based on YCN 1 LLC’s beliefs, assumptions and expectations of its future performance, taking into account all information currently available. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to YCN 1 LLC or are within its control. If a change occurs, YCN 1 LLC’s business, financial condition, liquidity and results of operations, including net asset value, assets under management, economic net income and fee-related earnings, may vary materially from those expressed in the forward-looking statements. The following factors, among others, could cause actual results to vary from the forward-looking statements: the general volatility of the capital markets; changes in YCN 1 LLC’s business strategy; availability, terms and deployment of capital; availability of qualified personnel and expense of recruiting and retaining such personnel; changes in the asset management industry, interest rates or the general economy; underperformance of YCN 1 LLC’s investments and decreased ability to raise funds; and the degree and nature of YCN 1 LLC’s competition. YCN 1 LLC. does not undertake any obligation to update any forward-looking statements to reflect circumstances or events that occur after the date on which such statements were made except as explicitly required by law